Invoice Financing or Factoring provides a flexible cash flow solution for SMEs, enabling them to sell their receivables (invoices) to financial institutions and receive early payments

Up to 90% of the invoice face value

1-3% per month with 2-3%

success fee

Subject to credit assessment

15 days - 1 year (up to the payment due date of the invoice)

Invoice financing is a widely utilized funding solution for businesses seeking to enhance their cash flow by reducing receivable days. This process involves a financial provider offering a percentage of your receivables at a discount and handling collections for you. It is often a more cost-effective choice compared to traditional business loans, as repayment relies on your buyer rather than your business cash flow.

Liberate your cash flow promptly by utilizing your receivables to promptly fund operational costs, overheads, or growth.

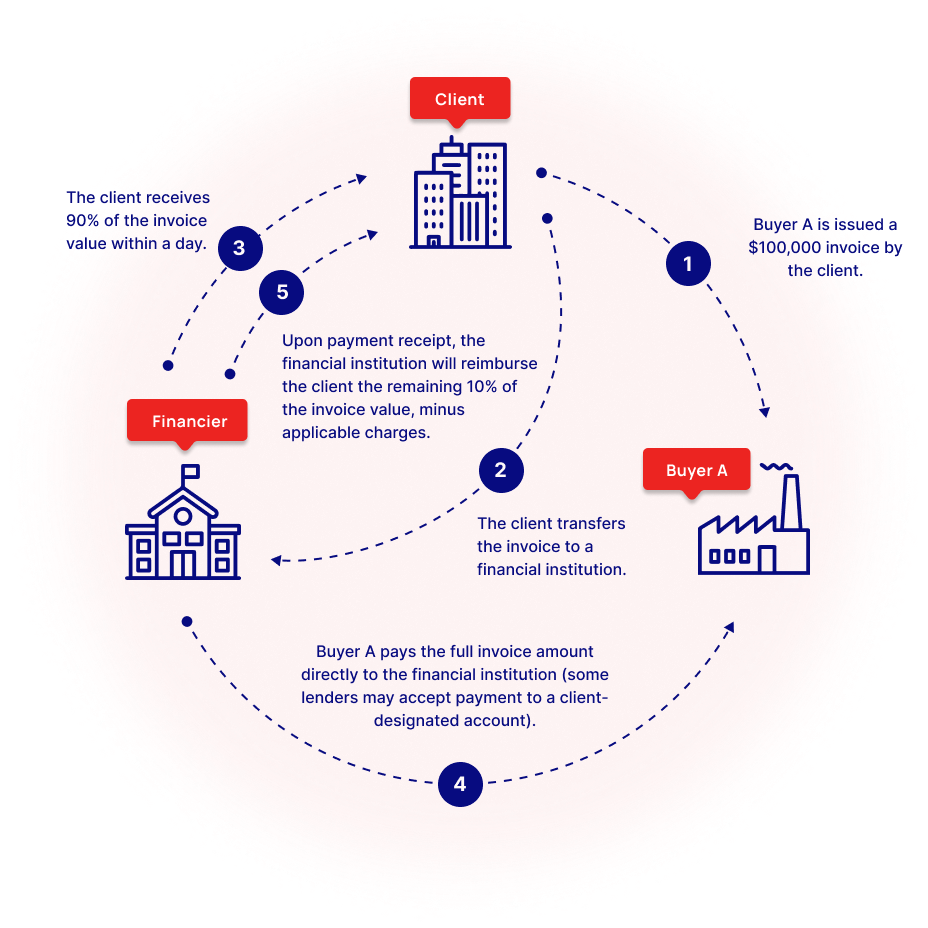

Check out the following diagram for a simple overview of how invoice financing operates.

The customer sells electronic products worth $100,000 to Buyer A on Day 1 and issues an invoice for the same amount. The invoice specifies a payment term of 45 days, meaning Buyer A will settle the payment on the 45th day from the sale.

By the 15th day, the customer needs $50,000 to procure new inventory for a fresh order, necessitating working capital. Consequently, the customer decides to sell their $100,000 receivables from Buyer A to a Financier. The Financier then notifies Buyer A about the invoice transfer and directs them to make the payment directly to the Financier on the due date (45th day).

Upon verification of the details and invoice, the Financier disburses 90% of the invoice value after deducting a factoring charge (resulting in $90,000 less a 1% fee of $900).

On the 45th day, the Financier collects the full invoiced amount directly from the buyer, which can be credited to the Financier's account or a designated account in the customer's name.

Upon receiving the payment on the same day, the customer receives 10% of the remaining invoice value from the Financier after deducting an interest charge of approximately 1% per 30 days. Since the financing was $90,000 for 30 days, the interest amounts to $900. The total amount paid for fees and interest in the process sums up to $1,800 ($900 factoring fee and $900 interest).

Unlike alternative business funding options, invoice financing offers accessible qualification, catering to newly established or financially distressed companies without the necessity of collateral or guarantors.

For small businesses, delays of 30, 60, or 90 days in receiving payments can hinder growth. However, not providing industry-standard payment terms may drive customers away. Invoice financing enables businesses to offer extended payment terms without concerns about cash flow disruptions.

Opting for factoring allows the financier to manage credit control and collections, freeing you to focus on business operations. This pertains to both domestic and international invoices.

Feel free to share your concerns in the message box or schedule an appointment below.

Stay informed about the latest happenings in the SME loan market by joining our mailing list.

More than 20 years of corporate Loan experience and networks to get your business going strong financially!